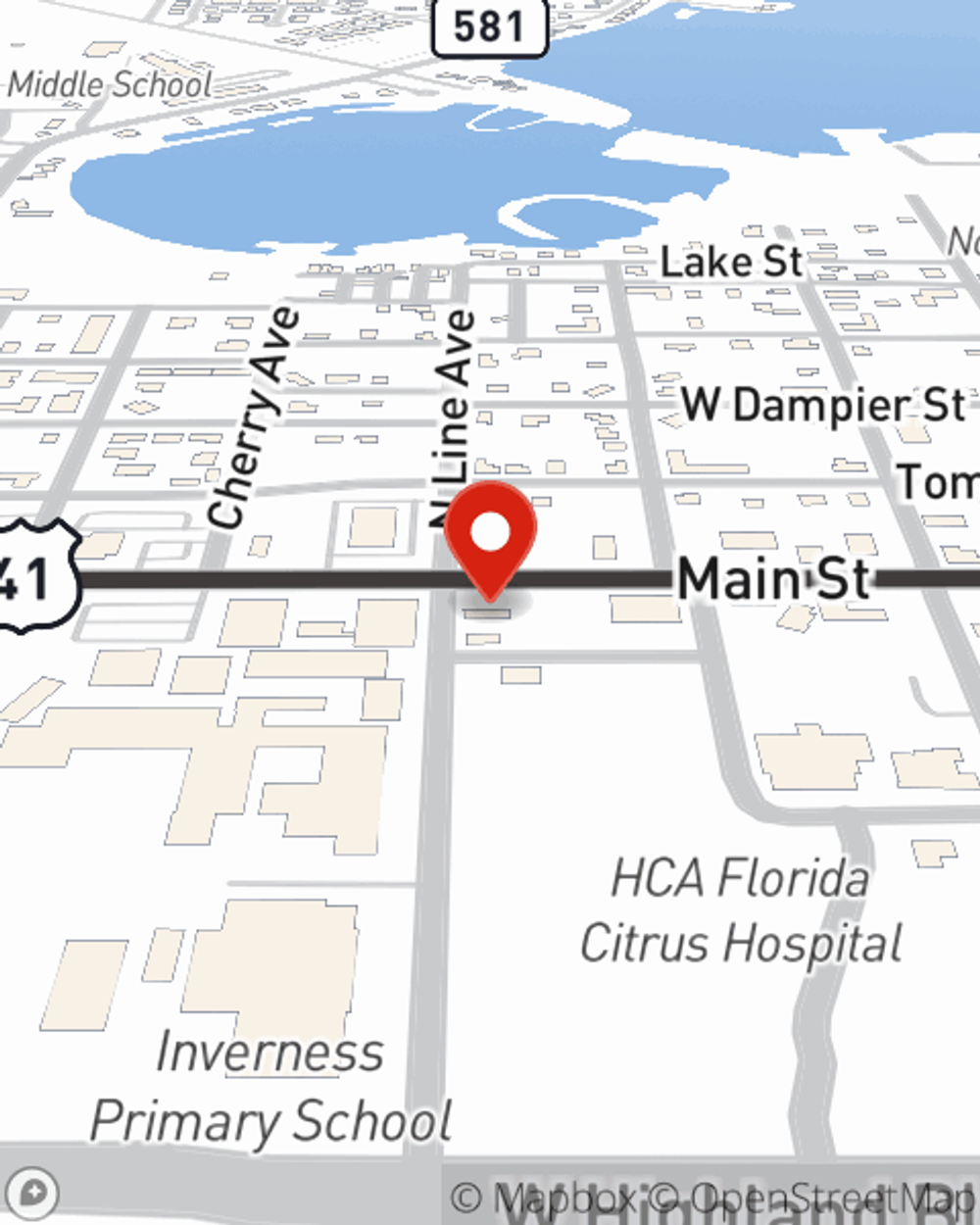

Life Insurance in and around Inverness

Coverage for your loved ones' sake

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

It's Never Too Soon For Life Insurance

The average cost of funerals nowadays is around $8,300, according a recent study by the National Funeral Directors Association. Unfortunately, it may be difficult for those closest to you to cover those costs as they mourn. That's where Life insurance with State Farm comes in. Having the right coverage can help your family pay for burial costs and not experience financial hardship.

Coverage for your loved ones' sake

Now is a good time to think about Life insurance

Put Those Worries To Rest

Fortunately, State Farm offers several coverage options that can be adjusted to correspond with the needs of your family members and their unique situation. Agent David M Rom has the deep commitment and service you're looking for to help you opt for coverage which can assist your loved ones in the wake of loss.

More people choose State Farm® as their life insurance company over any other insurer. Are you ready to see what a State Farm policy can do for you? Contact State Farm Agent David M Rom today.

Have More Questions About Life Insurance?

Call David M at (352) 341-3276 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®

David M Rom

State Farm® Insurance AgentSimple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®